2020 has proven to be one of the most volatile markets we’ve seen in the past decade. The year started with a large downturn, but has quickly rebounded due to the current COVID-19 pandemic and is trending to be one of the tightest-capacity markets we’ve experienced in quite some time. As we look to the remainder of 2020 and the beginning of 2021, there’s much uncertainty on if/when the market will stabilize. Because of this, we’re going to look at some of the factors that could lead to a market correction by analyzing the current environment and what exactly plays a role in forecasting what’s to come.

Tender Rejections and the Spot Market

Tender rejections are at a yearlong high. Increased tender rejections are caused by two main factors: capacity and alternative options. For one reason or another, carriers may reach capacity and would be physically unable to accept tenders due to not having the resources. We have seen carriers affected by a driver shortage after the passing of the Alcohol Clearinghouse, the ELD Mandate, and other regulations. Carriers have most recently dealt with the need to cut costs due to the market correction caused by the current pandemic.

The other main reason for rejections is having alternative options. While carriers do appreciate the luxury of having dedicated lanes, they need to make the most of the limited resources they have. With this, they may find a better alternative for their drivers, whether that be hauling for another broker or carrier, or playing the spot market for last-minute shipments, which leads to higher rates in return. Spot rates have increased 30% year over year, making this option more enticing, especially with the current economic climate.

Figure 1: Tender Volume Rejections (via Freightwaves)

With the rise of spot market rates, experts are forecasting that this could lead to inflated rates in the coming months in order to tighten the gap between spot and contract rates.

The Used Equipment Market and Driver Availability

Two additional carrier-related attributes can help predict the market: truck driver availability and hiring and the number of trucks changing hands on the used market. The driver shortage was an existing issue before the COVID-19 pandemic, but the situation did little to improve over the past few months.

Class 8 truck sales had decreased by 50% in April and 61% in May year-over-year sales. Typically, carriers will replace their new tractors and sell their used equipment to recoup some of the cost. Current times call for cost-cutting, resulting in carriers holding onto their tractors for longer, which ultimately causes a ripple effect for new class 8 vehicle sales. The class 8 vehicle sale decrease was a sign of the times and was the predecessor to the following months where class 5-7 vehicle sales dipped severely as well.

Figure 2: Historical Class 8 Net Orders & Sales (via Morgan Stanley Research & ACT)

The driver shortage has hit all carriers hard as the pool of eligible operators has taken a nosedive due to tightened regulations that have recently passed. This, paired with the impact COVID-19 has had on the economy has contributed to the issue. While some carriers have had to furlough drivers to cut costs, others have been quick to add to their fleet. Carriers that mainly specialize in grocery and consumer goods have hired drivers in the recent months, many of them being formerly furloughed operators at other carriers. Other carriers settled somewhere in the middle of this, and were luckily able to keep their current fleet intact, but were forced to put a temporary freeze on their recruiting efforts.

E-Commerce

Like other companies, e-commerce sites focus on historical data and past consumer behavior in procurement and stocking items. As we saw at the inception of the COVID-19 pandemic in America, the “panic-buying” of essential items such as hand sanitizer, cleansing wipes and other commodities caused a substantial delay in the fulfillment of those items.

To combat the surge, e-commerce companies had steered consumers away from purchasing non-essential items to steer more resources toward the production and fulfillment of essential products. For example, Amazon indefinitely pushed back their “Prime Day” and put a hold on advertising items other customers have bought. Other e-commerce companies have slashed advertising budgets by over 50%, both as a cost-cutting measure, and to shift their focus to other essential items. While e-commerce websites have since been able to re-stock and adjust their item inventory, the focal point going forward is how they will be able to adjust to the influx of orders with schools re-opening, as well as restaurants, and other public places moving closer to maximum capacity.

Figure 3: E-Commerce Buying Trends Since COVID-19 Start (via Commonthread Collective)

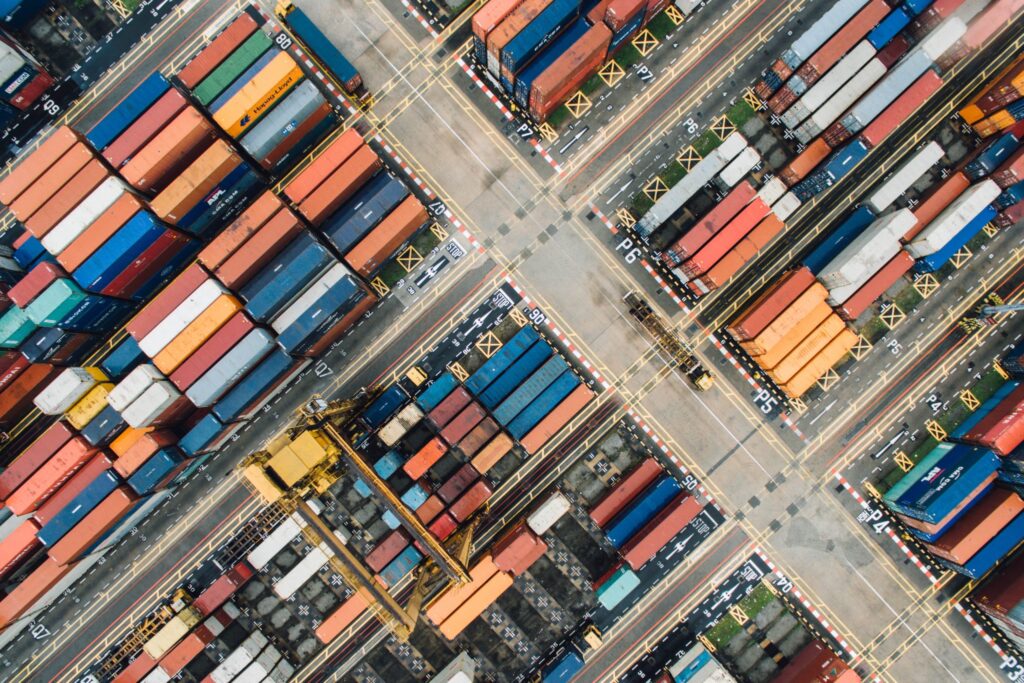

Port Activity

Port activity is another gauge of the direction the market is turning. When the COVID-19 outbreak first occurred, the United States responded by closing their ports to Chinese imports. Even before the pandemic truly hit the United States, we still felt the impact from the eastern hemisphere, as imported twenty-foot equivalent unit containers (TEUs) dropped by nearly 7% year over year.

As 2020 progressed, ports have started to recover. A few ports in California have actually seen a significant increase in year over year TEUs processed for the month of July. The United States’ busiest facility, the Port of Los Angeles, saw a significant surge of TEUs in July. Although it was a slight decrease from 2019, the large uptick in units processed is a bright sign for the import market in the coming months. The ports on the east coast and in the Gulf of Mexico have not had the same significant upswing as ports out west, but they have shown signs that experts believe point to gradual recovery to round out 2020.

While the market will always be volatile, a few factors will help predict future changes. Transportation and logistics is normally one of the first industries to see changes as an effect of the market, so keeping an eye on the supply chain will help other industries predict and prepare for what the future holds.

Sources:

Transport Topics (2020). Transport Topics Blog. et al. Retrieved 2020, from https://www.ttnews.com/

ACT Research Co., L. et al. (2020). ACT Research Blog. Retrieved 2020, from https://content.actresearch.net/

Shanker, R., Rice, S., &; McGarvey, C. (2020, August). Truck Stop/TLSS: Rate Expectations Turn Positive as Sentiment Continues Its Impressive Streak. Morgan Stanley. Retrieved 2020.

Cox, A. (2020). The second freight frenzy of 2020 is upon us [Web log post]. Retrieved 2020, from https://www.freightwaves.com/news/the-second-freight-frenzy-of-2020-is-upon-us?utm_content=137927088&utm_medium=social&utm_source=linkedin&hss_channel=lcp-11046286

Orendorff, A. (2020). Coronavirus Ecommerce Opportunities, Data & Strategies: Online Shopping in the Age of COVID-19 [Web blog post]. Retrieved from https://commonthreadco.com/blogs/coachs-corner/coronavirus-ecommerce#sources