As market conditions have continued to stabilize, the outlook for carrier demand remains somewhat uncertain due to potential tariffs and soft economic conditions. Carrier confidence has also started to worsen due to the recent drop in Class 8 orders, which have had the largest decline since 2016¹, along with a steady flow of fleet bankruptcies. After understanding the current state of the freight industry, it’s imperative for carriers to take the appropriate steps to beat the market in order to sustain profitability.

Current Market Conditions

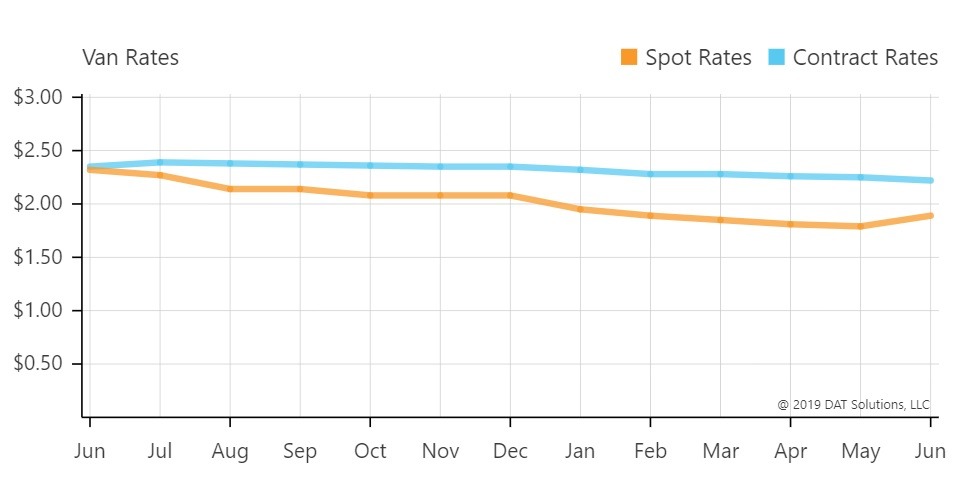

Spot and contract rates are currently mirroring the post-polar vortex stabilization of 2015, which rebounded after a severe capacity crunch in 2014. Projections show that the industry is on this same path after last year’s ELD-related capacity issues and the normalized freight cycle we are seeing this year. Spot market rates are a leading indicator of market shift. When the market is favorable to shippers, spot market rates will be less than contract rates. When the market is favorable to carriers, spot market rates will be greater than contract rates. We are currently in a shipper’s market across all major equipment types (van/reefer/flatbed), which is showcased on the right2.

Carriers that focus primarily on the spot market and have increased pay within the past few years in order to recruit more drivers could be the first to go out of business whenever the next freight recession hits.3 Although pay increases are warranted, it’s virtually impossible to decrease wages without the risk of losing labor. This is why contract freight will become especially important as the market continues to be oversupplied with capacity.

4 Actions Carriers Should Take

- Focus On Contract Freight: Finding consistent freight that aligns with your network and building a steady stream of backhaul loads should be key strategies. As explained above, the current market is favorable to shippers with spot market rates lagging behind contract rates. This serves as further proof that contract freight needs to become a core piece of any carrier’s business.

- Emphasize Service: Ask the brokers you work with if they have key performance indicator’s (i.e. – OTD %, tender acceptance, number of fall offs, etc.) to ensure you are meeting standard service requirements. Doing so will show that you have taken the initiative to try to improve and will put you in the top rankings amongst the brokers you work with.

- Understand Your Customers: Having a grasp on receiver intricacies will make picking up and delivering a much easier process. Ask your broker contacts for more information on the receiver before unloading or loading (i.e. – parking availability, hours, driver requirements, etc.). Communication is also key. Providing consistent updates as any issues arise in turn allows for brokers to keep their customers up to date on shipment status.

- Keep Up with Technology: Shippers value transparency as one of the most important attributes in their top carrier partners. Technology enables all parties to effectivity communicate updates and eliminates manual processes, and many brokers are now requiring 3rd party ELD integration. Be sure to remain current with technology updates from your broker partners to avoid being kicked out of their carrier network.

Taking these actions will ensure that you continue to develop mutually beneficial partnerships with brokers and most importantly, will help you to not follow suit of the many carriers who have had to make the hard decision of closing their doors.

Sources

2 https://www.dat.com/industry-trends/trendlines/van/national-rates

3 https://www.freightwaves.com/news/driver-pay-increases-may-leave-spot-market-fleets-vulnerable

4 https://www.freightwaves.com/news/conditions-for-fleets-are-deteriorating-and-it-will-get-bloody